New House Purchase Gst Rate . The gst on residential property is 1% for affordable housing and 5% for luxury properties. In this section you will find information. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. if you buy a property in ireland there are certain taxes that you will have to pay. determining your budget and financial planning. Buyer is eligible for gst rebate, for example the home is their principal residence. you may have to pay stamp duty charges for you new property. Commitment and a turning point for many.

from msofficegeek.com

Commitment and a turning point for many. you may have to pay stamp duty charges for you new property. if you buy a property in ireland there are certain taxes that you will have to pay. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. The gst on residential property is 1% for affordable housing and 5% for luxury properties. In this section you will find information. determining your budget and financial planning. Buyer is eligible for gst rebate, for example the home is their principal residence.

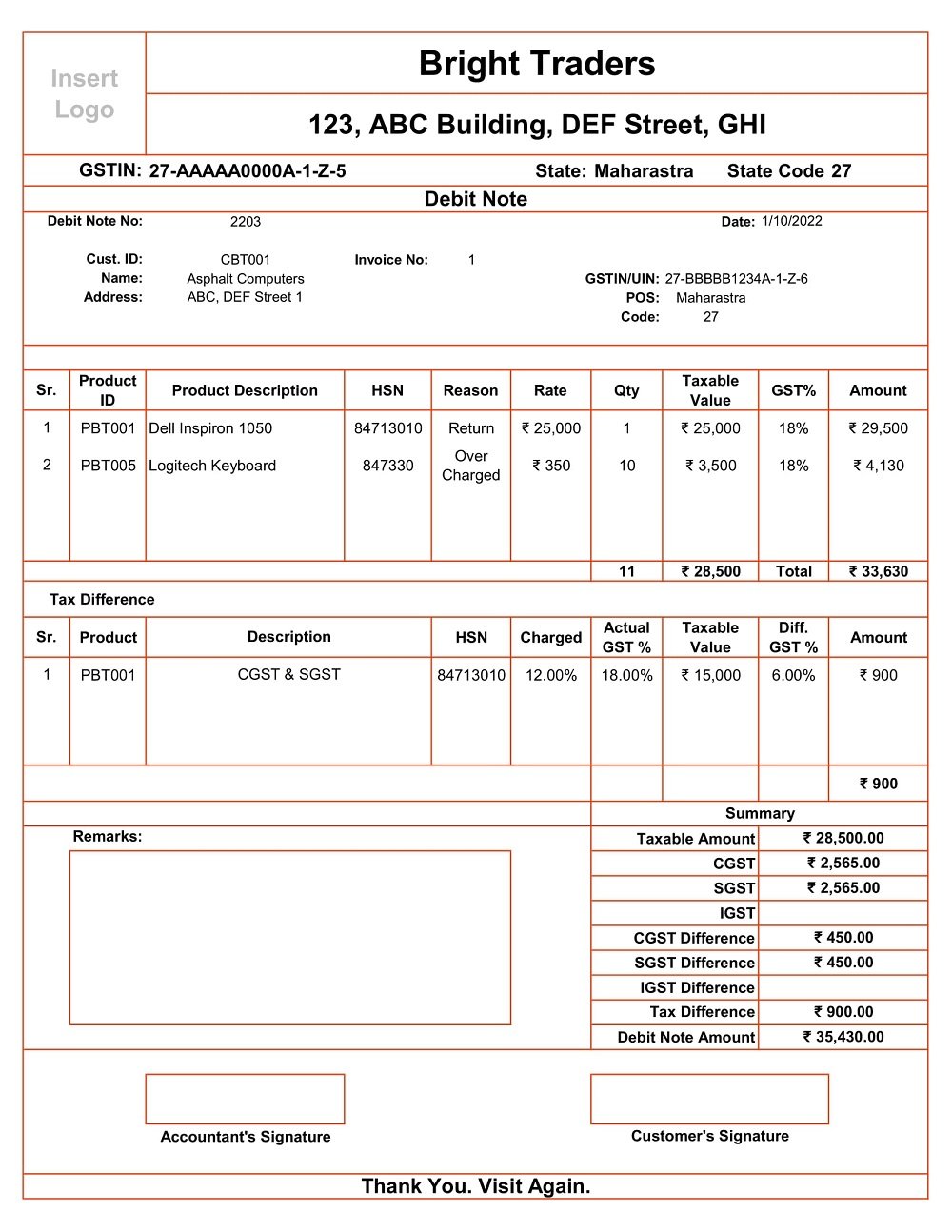

ReadyToUse GST Debit Note Format for Under Billing MSOfficeGeek

New House Purchase Gst Rate determining your budget and financial planning. you may have to pay stamp duty charges for you new property. The gst on residential property is 1% for affordable housing and 5% for luxury properties. Buyer is eligible for gst rebate, for example the home is their principal residence. Commitment and a turning point for many. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. determining your budget and financial planning. In this section you will find information. if you buy a property in ireland there are certain taxes that you will have to pay.

From www.billingsoftware.in

Purchase Order Format in GST GST Billing Software New House Purchase Gst Rate you may have to pay stamp duty charges for you new property. The gst on residential property is 1% for affordable housing and 5% for luxury properties. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. Buyer is eligible for gst rebate, for example. New House Purchase Gst Rate.

From www.teachoo.com

What is Bill of Supply in GST GST Invoice Format New House Purchase Gst Rate determining your budget and financial planning. Buyer is eligible for gst rebate, for example the home is their principal residence. The gst on residential property is 1% for affordable housing and 5% for luxury properties. you may have to pay stamp duty charges for you new property. stamp duty is calculated at 1% of the selling price. New House Purchase Gst Rate.

From taxguru.in

GST on under construction house property w.e.f. April 01, 2019 New House Purchase Gst Rate Buyer is eligible for gst rebate, for example the home is their principal residence. if you buy a property in ireland there are certain taxes that you will have to pay. In this section you will find information. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on. New House Purchase Gst Rate.

From msofficegeek.com

ReadyToUse GST Debit Note Format for Under Billing MSOfficeGeek New House Purchase Gst Rate Buyer is eligible for gst rebate, for example the home is their principal residence. Commitment and a turning point for many. if you buy a property in ireland there are certain taxes that you will have to pay. determining your budget and financial planning. The gst on residential property is 1% for affordable housing and 5% for luxury. New House Purchase Gst Rate.

From razorpay.com

GST Rates in 2024 List of Goods & Service Tax Rates Slabs New House Purchase Gst Rate stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. you may have to pay stamp duty charges for you new property. determining your budget and financial planning. Buyer is eligible for gst rebate, for example the home is their principal residence. The gst. New House Purchase Gst Rate.

From bgaccountinggroup.com

What Is GST And HST? Tips To Register BG Accounting and Business New House Purchase Gst Rate if you buy a property in ireland there are certain taxes that you will have to pay. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. determining your budget and financial planning. Buyer is eligible for gst rebate, for example the home is. New House Purchase Gst Rate.

From ssk.group

Real Estate Sector under GST SSK Developers New House Purchase Gst Rate Commitment and a turning point for many. Buyer is eligible for gst rebate, for example the home is their principal residence. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. you may have to pay stamp duty charges for you new property. determining. New House Purchase Gst Rate.

From www.teachoo.com

Entries for Sales and Purchase in GST Accounting Entries in GST New House Purchase Gst Rate Commitment and a turning point for many. you may have to pay stamp duty charges for you new property. determining your budget and financial planning. if you buy a property in ireland there are certain taxes that you will have to pay. stamp duty is calculated at 1% of the selling price of a residential property. New House Purchase Gst Rate.

From instafiling.com

GST on UnderConstruction Property (2023 Rates) India's Leading New House Purchase Gst Rate The gst on residential property is 1% for affordable housing and 5% for luxury properties. Buyer is eligible for gst rebate, for example the home is their principal residence. you may have to pay stamp duty charges for you new property. if you buy a property in ireland there are certain taxes that you will have to pay.. New House Purchase Gst Rate.

From www.indiatoday.in

GST rate hikes List of goods and services which are expensive now New House Purchase Gst Rate Commitment and a turning point for many. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. determining your budget and financial planning. In this section you will find information. you may have to pay stamp duty charges for you new property. Buyer is. New House Purchase Gst Rate.

From www.indiafilings.com

GST Rate Changes Latest from 22nd GST Council IndiaFilings New House Purchase Gst Rate you may have to pay stamp duty charges for you new property. In this section you will find information. Commitment and a turning point for many. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. determining your budget and financial planning. The gst. New House Purchase Gst Rate.

From cearxnkg.blob.core.windows.net

Tax Invoice Format With Gst In Excel at Tanya Rojo blog New House Purchase Gst Rate stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. you may have to pay stamp duty charges for you new property. Buyer is eligible for gst rebate, for example the home is their principal residence. Commitment and a turning point for many. if. New House Purchase Gst Rate.

From timesproperty.com

Understanding GST Rates in Real Estate A Complete Guide TimesProperty New House Purchase Gst Rate Commitment and a turning point for many. The gst on residential property is 1% for affordable housing and 5% for luxury properties. In this section you will find information. determining your budget and financial planning. you may have to pay stamp duty charges for you new property. Buyer is eligible for gst rebate, for example the home is. New House Purchase Gst Rate.

From commercialpropertyexperts.co.nz

GST and Commercial Property Transactions Commercial Property Experts New House Purchase Gst Rate if you buy a property in ireland there are certain taxes that you will have to pay. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. Commitment and a turning point for many. determining your budget and financial planning. The gst on residential. New House Purchase Gst Rate.

From www.paisabazaar.com

GST Invoice GST Invoice Format GST Invoice Rules Paisabazaar New House Purchase Gst Rate you may have to pay stamp duty charges for you new property. In this section you will find information. determining your budget and financial planning. if you buy a property in ireland there are certain taxes that you will have to pay. stamp duty is calculated at 1% of the selling price of a residential property. New House Purchase Gst Rate.

From www.jagranjosh.com

New GST Rates 2022 New GST Rates come into effect from July 18 Check New House Purchase Gst Rate you may have to pay stamp duty charges for you new property. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. if you buy a property in ireland there are certain taxes that you will have to pay. The gst on residential property. New House Purchase Gst Rate.

From www.researchgate.net

Product tax rates before and after implementation of GST Download New House Purchase Gst Rate In this section you will find information. stamp duty is calculated at 1% of the selling price of a residential property up to €1m, and 2% on the balance above. you may have to pay stamp duty charges for you new property. Buyer is eligible for gst rebate, for example the home is their principal residence. if. New House Purchase Gst Rate.

From instafiling.com

New GST Rates in India 2023 (Item Wise and HSN Code) New House Purchase Gst Rate Commitment and a turning point for many. In this section you will find information. you may have to pay stamp duty charges for you new property. Buyer is eligible for gst rebate, for example the home is their principal residence. The gst on residential property is 1% for affordable housing and 5% for luxury properties. determining your budget. New House Purchase Gst Rate.